Car Depreciation Method Ato . If you work out your deduction for expenses using the actual cost method,. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web a business car declines in value over time thanks to wear and tear. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. Web motor vehicle depreciation can be one of the largest deductions you can claim. Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. Using the wrong method can. Web depreciation of the motor vehicle. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Learn how to claim vehicle. Car depreciation, or decline in value, is the. Web make sure you use the correct calculation method when claiming motor vehicle expenses.

from odora.tinosmarble.com

If you work out your deduction for expenses using the actual cost method,. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Car depreciation, or decline in value, is the. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. Web make sure you use the correct calculation method when claiming motor vehicle expenses. Web motor vehicle depreciation can be one of the largest deductions you can claim. Web a business car declines in value over time thanks to wear and tear. Learn how to claim vehicle. Using the wrong method can.

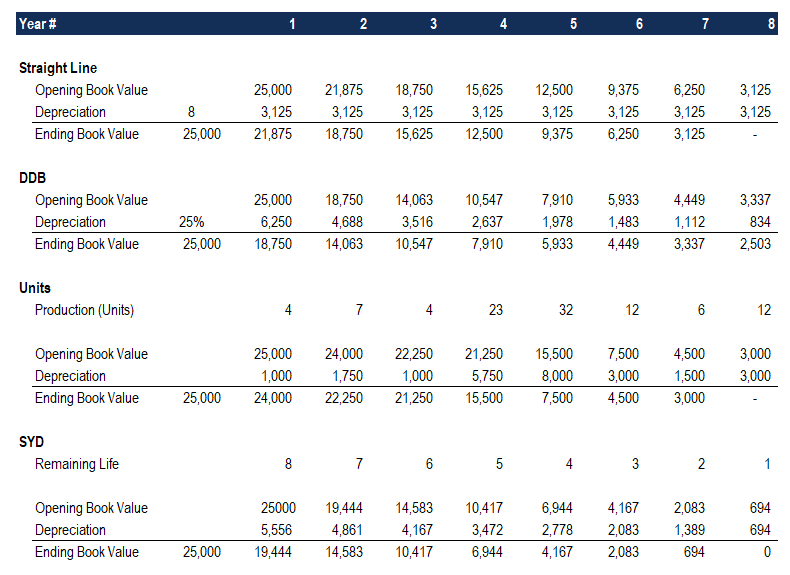

Depreciation Methods 4 Types of Depreciation You Must Know!

Car Depreciation Method Ato Using the wrong method can. Using the wrong method can. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. Web motor vehicle depreciation can be one of the largest deductions you can claim. Web depreciation of the motor vehicle. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web a business car declines in value over time thanks to wear and tear. Car depreciation, or decline in value, is the. Web make sure you use the correct calculation method when claiming motor vehicle expenses. If you work out your deduction for expenses using the actual cost method,. Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. Learn how to claim vehicle.

From www.godigit.com

Car Depreciation Different Rates and How to Calculate IDV Car Depreciation Method Ato Learn how to claim vehicle. Web make sure you use the correct calculation method when claiming motor vehicle expenses. Web motor vehicle depreciation can be one of the largest deductions you can claim. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web a business car declines in value over. Car Depreciation Method Ato.

From haipernews.com

How To Calculate Depreciation Expense Ato Haiper Car Depreciation Method Ato Web make sure you use the correct calculation method when claiming motor vehicle expenses. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. If you work out. Car Depreciation Method Ato.

From odora.tinosmarble.com

Depreciation Methods 4 Types of Depreciation You Must Know! Car Depreciation Method Ato Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Web make sure you use the correct calculation method when claiming motor vehicle expenses. Web motor vehicle depreciation. Car Depreciation Method Ato.

From atotaxrates.info

ATO depreciation rates and depreciation schedules AtoTaxRates.info Car Depreciation Method Ato From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web a business car declines in value over time thanks to wear and tear. If you work out your deduction for expenses using the actual cost method,. Web make sure you use the correct calculation method when claiming motor vehicle expenses.. Car Depreciation Method Ato.

From atotaxrates.info

ATO Depreciation Taxrates.info Car Depreciation Method Ato If you work out your deduction for expenses using the actual cost method,. Car depreciation, or decline in value, is the. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is. Car Depreciation Method Ato.

From marketbusinessnews.com

What is depreciation? Definition and examples Market Business News Car Depreciation Method Ato Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Web motor vehicle depreciation can be one of the largest deductions you can claim. Learn how to claim vehicle. Using the wrong method can. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10. Car Depreciation Method Ato.

From www.leasingoptions.co.uk

The Complete Guide to Car Depreciation Leasing Options Car Depreciation Method Ato Using the wrong method can. Learn how to claim vehicle. Car depreciation, or decline in value, is the. From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web a business car declines in value over time thanks to wear and tear. If you work out your deduction for expenses using. Car Depreciation Method Ato.

From allisonyelena.blogspot.com

Simple depreciation formula AllisonYelena Car Depreciation Method Ato Using the wrong method can. Learn how to claim vehicle. Web depreciation of the motor vehicle. Web a business car declines in value over time thanks to wear and tear. Car depreciation, or decline in value, is the. Web motor vehicle depreciation can be one of the largest deductions you can claim. Web make sure you use the correct calculation. Car Depreciation Method Ato.

From www.drivefuze.com

Car depreciation explained Drive Fuze Blog Car Depreciation Method Ato Using the wrong method can. Car depreciation, or decline in value, is the. Web make sure you use the correct calculation method when claiming motor vehicle expenses. If you work out your deduction for expenses using the actual cost method,. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate. Car Depreciation Method Ato.

From marketbusinessnews.com

What is depreciation? How does depreciation affect profit? Market Car Depreciation Method Ato Using the wrong method can. Web a business car declines in value over time thanks to wear and tear. If you work out your deduction for expenses using the actual cost method,. Car depreciation, or decline in value, is the. Web make sure you use the correct calculation method when claiming motor vehicle expenses. The depreciated value of the car. Car Depreciation Method Ato.

From npifund.com

Methods of Depreciation Formulas, Problems, and Solutions (2022) Car Depreciation Method Ato Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. If you work out your deduction for expenses using the actual cost method,. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Web a business car declines. Car Depreciation Method Ato.

From atotaxrates.info

Depreciation of Vehicles atotaxrates.info Car Depreciation Method Ato Learn how to claim vehicle. Web a business car declines in value over time thanks to wear and tear. Car depreciation, or decline in value, is the. Using the wrong method can. Web depreciation of the motor vehicle. If you work out your deduction for expenses using the actual cost method,. The depreciated value of the car in 2021 is. Car Depreciation Method Ato.

From ukhardu.blogspot.com

How To Compute Depreciation Value Used car depreciation Value killer Car Depreciation Method Ato Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. Web a business car declines in value over time thanks to wear and tear. Web make sure you. Car Depreciation Method Ato.

From nfu.lookerspersonalleasing.co.uk

Car depreciation Blog Leasing Car Depreciation Method Ato Using the wrong method can. Web depreciation of most cars based on our estimates of useful life is 25% per annum on a diminishing value basis. Car depreciation, or decline in value, is the. Web depreciation of the motor vehicle. Web motor vehicle depreciation can be one of the largest deductions you can claim. If you work out your deduction. Car Depreciation Method Ato.

From www.online-accounting.net

Straight Line Depreciation Method Online Accounting Car Depreciation Method Ato Car depreciation, or decline in value, is the. Using the wrong method can. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. If you work out your deduction for expenses using the actual cost method,. Web make sure you use the correct calculation method. Car Depreciation Method Ato.

From www.slideserve.com

PPT Everything You Need To Know About Car Depreciation PowerPoint Car Depreciation Method Ato From 1 april 2008, the deemed depreciation rate for cars acquired on or after 10 may 2006 is 25%. Web depreciation of the motor vehicle. If you work out your deduction for expenses using the actual cost method,. Using the wrong method can. Web a business car declines in value over time thanks to wear and tear. Learn how to. Car Depreciation Method Ato.

From www.studocu.com

Depreciation Method DEPRECIATION METHOD 10/12/2021 Prepared by Engr Car Depreciation Method Ato If you work out your deduction for expenses using the actual cost method,. Web depreciation of the motor vehicle. Learn how to claim vehicle. The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. Web depreciation of most cars based on our estimates of useful. Car Depreciation Method Ato.

From www.slideserve.com

PPT Linear Automobile Depreciation PowerPoint Presentation, free Car Depreciation Method Ato The depreciated value of the car in 2021 is the cost of the car, reduced by the deemed depreciation rate that applied at the time. Web depreciation of the motor vehicle. Web depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis. If you work out your deduction for expenses. Car Depreciation Method Ato.